Where the Money Goes for a Gallon of Gas in California as State Tax Increases

SAN DIEGO (KGTV) — Gas prices in San Diego County have dropped about 25 cents over the past month, but starting Monday, a higher tax will slightly increase costs.

Where the Money Goes for a Gallon of Gas in California

| Component | Imposed | Cents | Cum |

| Underground storage tank fee | California | 2.0 | 2.0 |

| State and local sales taxes | California | 10.0 | 12.0 |

| Mystery surcharge | California | 35.0 | 47.0 |

| Environmental programs | California | 51.0 | 98.0 |

| State excise tax | California | 58.0 | 156.0 |

| Federal excise tax | Federal | 18.4 | 174.4 |

| Distribution and marketing costs/profits | Oil Co | 51.0 | 225.4 |

| Refinery costs and profits | Oil Co | 58.0 | 283.4 |

| Cost of crude oil | Oil Co | 206.0 | 489.4 |

Summary

There are several key drivers for the high cost of gasoline in California:

1. Taxes:

- State excise tax: Recently increased to 59.6 cents per gallon

- Federal excise tax: 18.4 cents per gallon

- State and local sales taxes: About 10 cents per gallon

- Underground storage tank fee: 2 cents per gallon

2. Environmental programs and regulations:

- Cap and trade program

- Low Carbon Fuel Standard

- Cleaner-burning gasoline formulation requirements

3. Supply and distribution factors:

- California is described as a "gasoline island" due to its unique fuel requirements

- Limited ability to import gasoline from other states

- Refinery maintenance and capacity issues

4. Market factors:

- Cost of crude oil

- Refinery costs and profits

- Distribution and marketing costs and profits

5. Policy decisions:

- Push for zero-emission vehicles by 2035

- New oversight and regulations on oil companies

6. "Mystery surcharge":

- An unexplained price differential of about 35 cents per gallon since a 2015 refinery explosion

7. Geographic isolation:

- California's distance from other refining centers - Oregon is no closer to refining centers, but is 72 cents cheaper

8. Declining in-state production:

- California's crude oil production has decreased by 71.5% since 1985

These factors combine to make California's gasoline prices the highest in the nation, with a significant gap between California's prices and the national average. The article notes ongoing debates between state officials and the oil industry about the reasons for these high prices.

California gas tax increases again on Monday

Gas prices in San Diego County have dropped about 25 cents over the past month, but starting Monday, a higher tax will slightly increase costs.

"I don't know what an extra two cents is going to do, but it's probably not gonna stop there," said Joe Silverman, an economics professor in the San Diego area. "We've kind of taken the increase in gas prices over the last couple of years from $4 to $5 per gallon pretty calmly."

According

to data from the California Energy Commission, starting Monday, drivers

will be paying 90 cents in taxes per gallon of gas, broken down as

follows:

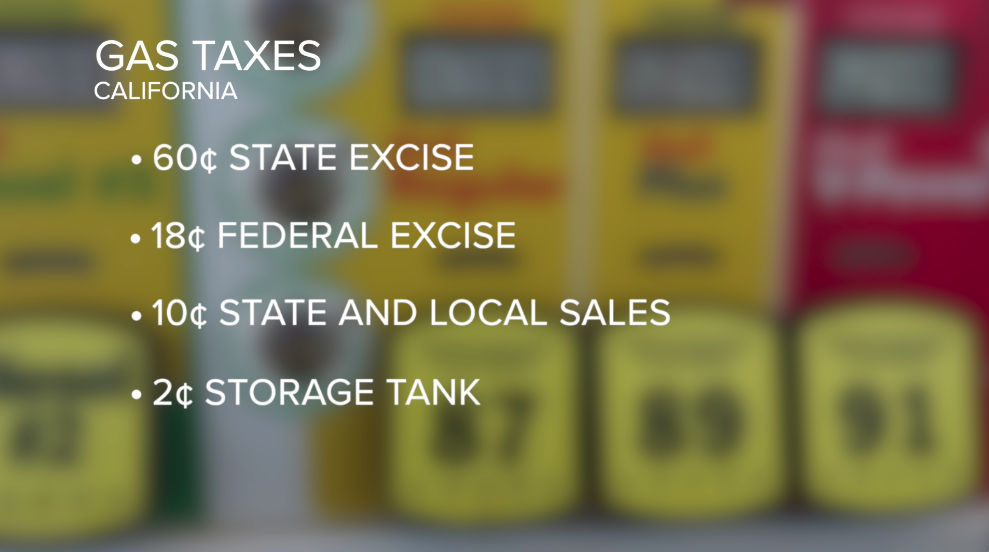

- $0.60 on state excise tax

- $0.18 on the federal excise tax

- $0.10 cents on more state and local sales taxes

- $0.02 for a state underground storage tank fee

ABC 10News

"This is just way over government regulation, and now is not the time," San Diego County Supervisor Jim Desmond said at a news conference in March, hoping to stop the increase from being implemented.

Desmond said the state is already too expensive. However, Governor Gavin Newsom blamed high prices on oil companies.

In an interview with Fox News following the second Republican Presidential Debate in September, Newsom said Californians are being gouged by oil companies.

Silverman questions this narrative. He wonders if the state's push for zero-emission vehicles by 2035 could be influencing prices.

"If you're the CEO of an oil company, you have to be charging more in order to make up for the possibility that you may not be in business anymore in California," he said. "If this mandate for no more gasoline-powered cars goes into effect in 2035 or sometime thereafter, there won't be a need for any gasoline because people will be transitioning."

In neighboring Arizona, the average gas price is $1.23 cheaper than in California, according to AAA. But Arizona pays just 53 cents less in state excise tax.

Silverman said there are a number of other variables that go into California's high gas prices, beyond taxes.

"We're sort of in what we call a gasoline island, meaning that we can't just get gasoline from Texas or another state because it's got to be formulated in order to meet the different air pollution requirements of different parts of the state," he said.

A report released by the state last year found funding from gas taxes will drop by almost $6 billion over the next 10 years. According to Caltrans, the state excise tax funds 80% of highway and road repairs.

Copyright 2024 Scripps Media, Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

As tensions mount between the petroleum industry in California and state policymakers, the cost of a gallon of gasoline just got a smidgen more expensive this week.

Monday marked the start of the new fiscal year and California’s state excise tax on gasoline increased 1.7 cents per gallon. That’s part of the annual adjustment for inflation that is part of Senate Bill 1, which the Legislature in Sacramento passed and then-Gov. Jerry Brown signed into law in 2017.

The excise tax rose on July 1 from 57.9 cents per gallon to 59.6 cents.

Last summer, the excise tax jumped 4 cents per gallon from the previous year because the rate of inflation was higher.

Formally called the Road Repair and Accountability Act, the SB 1 gas tax expects to raise $52.4 billion over 10 years. More than $3.2 billion per year will go the Road Maintenance and Rehabilitation Program that includes $400 million for bridges and culverts, $200 million local entities and $100 million for bicycle and pedestrian projects.

California has the highest state excise tax on gasoline in the country. Pennsylvania is second, charging 57.6 cents per gallon.

In addition to state taxes, motorists in every state also pay a federal excise tax of 18.4 cents per gallon.

California has the most expensive price per gallon of gasoline in the country. According to AAA, the average price in Orange County on Friday came to $4.69. That’s $1.19 higher than the national average of $3.50 a gallon. Statewide, the average price per gallon in California stood at $4.79.

The war of words ramps up

For the past several decades, the relationship between the petroleum industry and a political class in California that has steadily moved to the left has been strained. But the fault lines appear to be deepening.

Sharp price spikes in the past two summers prompted Gov. Gavin Newsom to accuse oil companies and refiners in the state of “lying and gouging Californians to line their own pockets.”

The industry has recently taken on a more visible role in pushing back, saying the difference between the prices motorists in the Golden State pay compared to drivers elsewhere in the country is primarily due to decisions made by California’s elected officials.

For example, drivers pulling up at many Chevron gas stations in the San Diego area and across California may see a sign that reads, “Filling up your tank is a lot cheaper in other states.” The sign includes a QR code that sends users to a page called the Chevron Advocacy Network.

A sign at a Chevron gas station on First Avenue in San Diego about high gasoline prices, directing motorists to a QR code that links to the company’s interpretation of why gas prices in California are so high. (Rob Nikolewski/The San Diego Union-Tribune)

The page mentions the recent increase in the state excise tax, shows a graphic of the price of gas in California relative to other states and says policymakers are “just getting started. They plan to drive gas prices even higher with increased environmental fees in the coming years.”

The QR link also provides access to send a letter or make a call to local legislators to “let them know you’re fed up with California’s high gas prices.”

Chevron spokesman Ross Allen said the campaign wants “drivers to understand how expensive state policies really are.” He did not divulge how many customers have registered using the QR code since it was introduced late last summer.

“We (could) fully support the state’s choices, as far as what types of laws it wants to put in place,” Allen said. “But what we don’t support is dissembling or going out and making us the bad guys about costs that Sacramento has imposed on the drivers. It’s just not fair to us.”

The Western States Petroleum Association, an industry trade group, has posted highway billboards and videos making similar arguments.

So have organizations such as Californians for Energy Independence and Californians for Affordable and Reliable Energy that have each run TV commercials across the state. Critics of the campaigns have labeled the organizations as industry front groups.

The ads have come on the heels of the Legislature in 2023 passing and Newsom signing the awkwardly named Senate Bill X1-2.

Hailed by the governor’s office as the “nation’s first price gouging law,” SB X1-2 created the Division of Petroleum Market Oversight to monitor the state’s crude oil and gasoline companies. It also requires refineries to report maintenance schedules in advance and provide daily reports on the market and imports.

In addition, the legislation gives the California Energy Commission authority to penalize oil companies if they exceed a “maximum gross refining margin.” The details of what will trigger the penalty — the first of its kind in the U.S. — and when it will be enforced are still being worked out.

During a briefing with reporters two months ago, the man picked by Newsom to head the Division of Petroleum Market Oversight took a few jabs at the industry.

Division director Tai Milder said that preliminary analysis of an increase in gas prices this spring “were really profit spikes for industry.”

Milder stopped short of accusing refiners of price gouging but said, “we see that refineries are once again planning to do maintenance work that takes capacity offline during busy driving months. And at the same time, refineries are not ensuring that we have adequate backup and replacement supplies to prevent the prices from going up.”

The Western State Petroleum Association fired back. “Those claims just show a fundamental misunderstanding of how this industry works,” said the group’s director of communications, Kevin Slagle.

“Purposely taking down a refinery when demand is high is not how the industry operates,” Slagle said. “Would Six Flags or Disneyland want to shut down during spring break or summer?”

Newsom appears to relish sparring with the industry.

In March, the governor’s website said “California’s new price gouging law created oversight and accountability tools, and the state’s new oil watchdog has been digging into the industry’s operations so Big Oil can’t price gouge people like they had been before to further boost their profits.”

Gov. Gavin Newsom announces the signing of Senate Bill X1-2 to Democrats in the Legislature in Sacramento on March 28, 2023. The bill requires California refineries to submit more data to state authorities and creates the Division of Petroleum Market Oversight. (California Governor’s Office)

Newsom took another jab last week, after the oil industry announced its withdrawal of a proposed referendum from the November ballot challenging a state law that imposes new restrictions on oil and gas wells within 3,200 feet of homes and schools.

“Big Oil saw what they were up against — and they folded, again,” Newsom said in a statement. “No parent in their right mind would vote to allow drilling next to daycares and playgrounds.”

The California Independent Petroleum Association said the industry will instead challenge the statute in court. The trade group says expanding the setback rule will lead to even higher gas prices and more imports of foreign oil from “counties that do not uphold the same environmental or labor standards.”

In 2023, 60.7 percent of oil supply sources to the state’s refineries came from foreign imports, according to the California Energy Commission.

Breaking down the costs and fees … and that ‘mystery surcharge’

A long list of factors go into what a California motorist pays for a gallon of gasoline.

After SB X1-2 passed, the state’s energy commission created an online dashboard of each component. As per the dashboard’s most recent post on June 24, the breakdown per gallon looked like this:

- $2.06 for the cost of crude oil

- 58 cents for the state excise tax (which went up to 59.6 cents July 1)

- 58 cents for refinery costs and profits

- 51 cents for distribution and marketing costs, plus profits

- 51 cents for environmental programs

- 18 cents for the federal government’s excise tax

- 10 cents for state and local sales taxes, and

- 2 cents for the state’s underground storage tank fee, which was established in 1991 to clean up leaks from petroleum tanks

The environmental taxes and fees includes things such as California’s cap and trade program (that requires suppliers of polluting fuels to purchase allowances to offset the emissions that come from burning those fuels) and the Low Carbon Fuel Standard (that mandates suppliers of fuels with high carbon intensity to purchase credits from makers of fuels with lower carbon such as ethanol and biodiesel).

Even with all the above-mentioned components in play, there’s another potential price differential that’s been debated for years in California.

UC Berkeley economics professor Severin Borenstein calls it a “mystery surcharge” that to 2015 when an explosion at an Exxon Mobil refinery in Torrance knocked off about 10 percent of the state’s gasoline supply, driving up prices.

After normal operations resumed, prices went down modestly but never returned to their pre-explosion margins. Even after taking California’s high taxes and fees into account, Borenstein’s data show a “mystery surcharge” that has hovered around 35 cents per gallon since the Torrance explosion.

That differential has been passed onto drivers in the state to the tune of $50 billion, by Borenstein’s estimation.

“I have investigated all the obvious candidates — cap and trade, the Low Carbon Fuel Standard and the cost of producing our cleaner burning gasoline — and none of those explain it,” Borenstein told the Union-Tribune last fall. “It’s a problem. There may be a benign explanation but it’s definitely not an obvious benign explanation.”

Borenstein hopes the creation of the Division of Petroleum Market Oversight can eventually figure out why.

Going forward, and a quick look back

In the meantime, buying gasoline-powered vehicles will soon be more difficult in California.

Four years ago, Newsom issued an executive order mandating the elimination of the sale of all new internal combustion cars and trucks by 2035 — and in two years, the first of a series of staggered sales quotas goes into effect.

Under standards passed by the California Air Resources Board, at least 35 percent of model year 2026 passenger cars and trucks sold in the state will be electric vehicles, plug-in hybrids or hydrogen fuel cell vehicles. The numbers ramp up each year, going to 68 percent in 2030 and 100 percent by 2035.

State policymakers have long said they are confident the requirements will be met. But, in no surprise, the petroleum industry is skeptical.

“If California wants to limit customer choice, we don’t believe it’s a good policy, but that’s their decision,” said Allen, the Chevron spokesman. “What we really believe, though, is that gasoline is going to be a a big part of the transportation mix for a very long time and we want to help people buy it in a way that doesn’t break their bank accounts.”

Environmental groups, on the other hand, applaud the transition and defend the state’s transportation and energy policies.

“We can’t keep denying what the impacts of global warming are and just hope they go away,” said Dan Jacobson, senior advisor for Environment California. “I think the governor and the Legislature are being smart to take the actions that science is basically demanding we take … I just wish the (petroleum industry) would use their money and influence to help move California’s economy to where it should be, not where it has been.”

Amid the debate, it’s sometimes easy to forget that not very long ago, California was considered an oil state.

In 1985, the Golden State produced 394 million barrels of crude oil, according to the U.S. Energy Information Administration. Only Texas and Alaska accounted for more.

By 2023, California produced just over 112 million barrels — a decline of 71.5 percent, compared to its 1985 output.

Gas Buddy Cost by State

Comments

Post a Comment