California Property fire insurance in transition as Rates Increase and Policy Availability Declines - Does Prop 103 need rewrite?

|

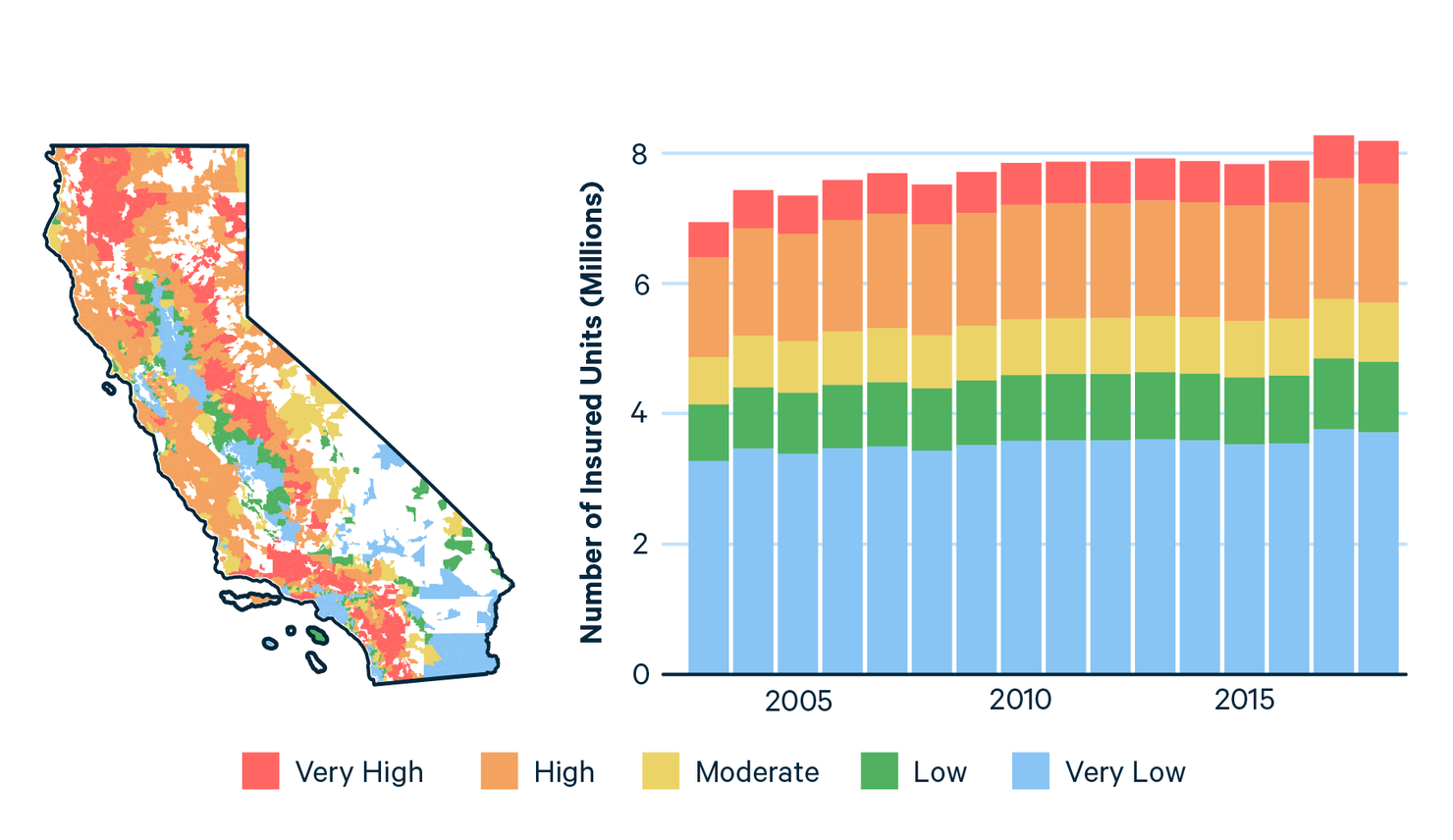

Map of Insurer-Initiated Nonrenewal Rate in California in 2019 by ZIP Code |

California fire insurance: FAIR Plan going through growing pains - CalMatters

|

Market Share of FAIR Plan Policies in California by Fire Risk Category, 2003–2018 |

|

Premium Increase Percentage, 2003–2018, in California |

Insurance Availability and Affordability under Increasing Wildfire Risk in California

In summary

As the FAIR Plan writes more fire-insurance policies, homeowners complain about poor service, rising costs and threats of getting kicked off.

The fire-insurance premium for Bill King’s home has risen 145% since 2017 — from $399 to $979 — under the California FAIR Plan, the state’s last option for homeowners seeking fire insurance.

Add that to the increase in his auto-insurance premium, and King, who lives in Running Springs in the San Bernardino Mountains, is worried.

“What do I do?” asked King, a retiree who will turn 70 years old this summer. “Do I move out of California? At some point I’m going to have to look at things… Will I be able to face future increases depending on how long I’ll live?”

A former Orange County employee, he said he’s having a tough time wrapping his head around the situation: “It’s hard when you’ve planned your retirement and your insurance company comes along and threatens your economic well-being.”

King’s story is similar to that of other property owners who have turned to the FAIR Plan as many insurers have stopped issuing fire insurance in the state, citing climate risks and inflation. As the FAIR Plan has exploded in size — from 126,709 policies in 2018 to more than 350,000 today — homeowners and insurance brokers say they are now facing problems such as delays in mortgage closings, or homeowners losing their coverage.

Recently, King found he was unable to pay for his policy renewal online, as he usually does. He couldn’t email the FAIR Plan because the plan’s website does not provide an email address. Instead, the website tells homeowners to contact their insurance brokers. King’s broker found out that he had been assigned a new policy number without his knowledge. He barely had time to send a payment via his broker, putting him dangerously close to cancellation. Based on his individual experience, King has concluded that the FAIR Plan “is doing everything it can to help policies lapse.”

The FAIR Plan Association, a pool of insurers required by state statute to provide fire-insurance policies when property owners can’t find them elsewhere, is experiencing major growing pains.

The California Insurance Department, which under state law has oversight over the FAIR Plan — including approving its requested rate changes — in 2020 investigated consumer complaints about non-renewals and cancellations. But even after an agreement late last year that included the FAIR Plan vowing to change some of its practices, there continue to be fresh signs of turmoil.

The plan is supposed to be a temporary solution as well as a last resort for property owners, but many people, like King, have been buying insurance through the association for years.

Hilary McLean, a FAIR Plan spokesperson, said the number of policy-holders who stay on the plan has increased over the years; 90% of current FAIR Plan customers are renewing their policies for another year.

The Insurance Department has proposed new regulations, expected to be finalized at the end of the year, to try to get insurers to resume writing fire policies in the state again. But it could be a couple of years until that happens, so the FAIR Plan is likely to continue growing, which could threaten its solvency because it is taking on additional high-risk policies.

“It’s clear that a growing FAIR Plan is a problem for all Californians because of the solvency risks from a major wildfire,” said Michael Soller, spokesperson for the Insurance Department, in an email. “The commissioner’s strategy is focused on returning people to the normal market from the FAIR Plan.”

Last year, lawmakers concerned about the solvency of the FAIR Plan tried to find a legislative solution to address it and other concerns about the state’s insurance market, but no lawmaker sponsored a bill to do so.

A copy of the proposed bill language, seen by CalMatters last week, shows it would have allowed the FAIR Plan to pay for claims by issuing bonds through the California Infrastructure and Economic Development Bank, which provides low-cost financing to state and local government entities. Although the FAIR Plan is not a state entity, the bill would have deemed it “in the public interest” for the FAIR Plan to qualify for financing through the bank.

FAIR Plan President Victoria Roach refused to speak on the record for this story. Spokesperson McLean said the association is dealing with an onslaught of new applications — about 900 a day, down from 1,000 a day last November but up from 350 a day in December 2022. Incoming phone calls nearly doubled over the last half of 2023, to more than 50,000 phone calls a month. The association has hired more people, bringing the number of staff to more than 200 employees plus 80 temporary workers, to help handle the additional workload.

Making matters worse, at the end of last year the FAIR Plan went ahead with long-planned changes to its software system, leading to confusion. McLean acknowledged that led to some homeowners getting kicked off the plan — or as King describes his case, almost getting kicked off — for payment issues.

Georgia, a Placer County homeowner who requested that her last name not be used for privacy reasons, said that in mid-December, her insurance broker informed her the day her premium was due that her payment had not been received, even though the money was in escrow and she later found out that her mortgage company had already paid it. The result: She, her husband and their three kids had to part with $2,380 right before Christmas to pay their premium because they didn’t want to risk losing fire insurance.

“That was my car payment, Christmas, everything we had,” she said. Her broker, mortgage company and the FAIR Plan told her she would get her money back on Jan. 5, she said, but added that she has yet to receive it.

Meanwhile, insurance broker Tyler Nelson said the new system caused delays that led to his clients losing out on loans for homes in escrow. Nelson said he would call the FAIR Plan, wait on hold for three hours and get no help. The new system, called Duck Creek, is “the most awful thing I’ve literally ever dealt with,” he said in an email.

The FAIR Plan would not discuss individual cases and complaints. McLean said the association notified brokers that they were adopting a new system, and offered them training and help. She also said the plan has made changes that “have greatly reduced delays and otherwise improved service levels.”

“In the very rare instance of a policy being canceled in error, the FAIR Plan works diligently to resolve the issue and restore coverage per the customer’s original policy agreement,” she added.

Soller, the spokesman for the Insurance Department, said consumers should contact the department if they have trouble getting coverage from the FAIR Plan.

Even before the FAIR Plan’s software transition, Ann Avalos lost her Auburn home’s fire-insurance policy in 2021 because of a payment issue after her mortgage was sold to another company.

The FAIR Plan “didn’t contact anyone until days before they dropped me,” she said, and refused to give her a grace period or reinstate her. “No communication, customer service, compassion,” she added. Her only recourse was to reapply for another policy, and she said her $2,257 annual premium increased to $3,481. Last year, she said it rose again, to $3,686. And because she can’t get fire insurance anywhere else, she has no choice but to accept the price increases.

Asked to respond, McLean said: “FAIR Plan policy agreements detail customer responsibilities… these responsibilities are consistent with industry standards, such as on-time payments and maintaining the structural integrity of the dwelling.”

“Why wouldn’t they drop you?” Avalos asked, noting that the association’s members are the insurers themselves. “Now they have the opportunity to double what they charge you.”

“We disagree with this characterization,” McLean said. “FAIR Plan rates are approved by the California Department of Insurance and rates are the same for new policyholders and renewing customers.”

The agreement reached by the Insurance Department and the FAIR Plan in November over complaints of non-renewals and cancellations between 2016 and 2019 has led the plan to make changes. One of them is to allow policy-holders to pay a surcharge if there’s a fixable issue on their property, instead of citing it as a reason to cancel their plan. Once the issue is taken care of, the surcharge is canceled. Soller, speaking for the state Insurance Department, said that because of the agreement, the FAIR Plan “should be making it easier, not harder,” for homeowners to renew their plans.

As King thinks about his own insurance worries and his future in California, he has also had to contend with FAIR Plan premium increases for his local church, where he is an associate pastor. A couple of years ago, he said, the fire-insurance premium for the church’s main building doubled from $4,000 to $8,000.

“That’s a lot of money for our little church,” he said, noting that the church’s annual budget was less than $70,000. So instead he shopped around and found a business policy that included fire insurance, which is costing the church about $6,000. “Insurance at times seems like a great evil perpetrated upon us,” he said.

|

The Number of Housing Units Insured in California by Fire Risk Category, 2003–2018 |

|

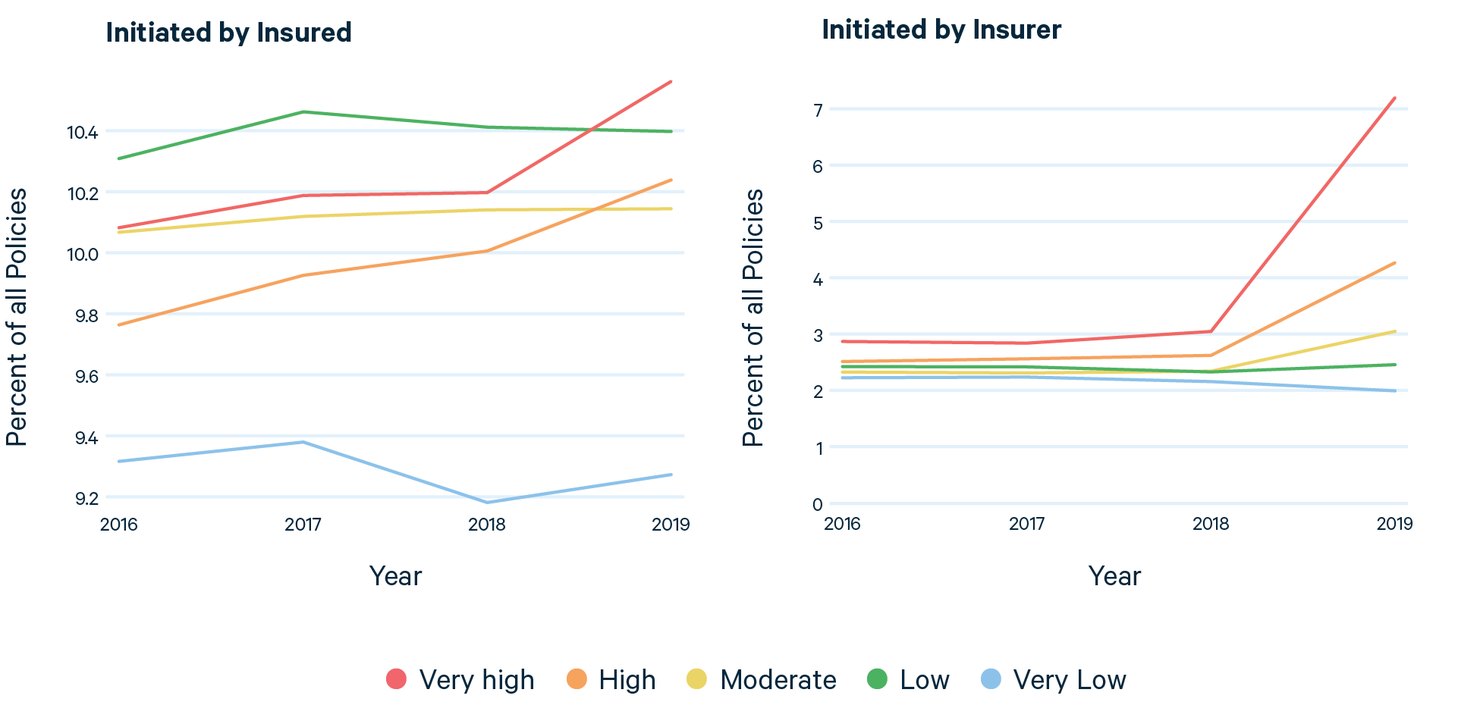

Insurance Nonrenewals Initiated by Insurers in California by Fire Risk Category, 2016–2019 |

Things to know about California's new proposed rules for insurance companies | AP News

ADAM BEAMSACRAMENTO, Calif. (AP) — Months after California’s home insurance market was rattled by major companies pausing or restricting their coverage, the state’s top regulator said Thursday that he would write new rules aimed at persuading insurers to continue doing business in the nation’s most populous state.

Seven of the 12 largest insurance companies by market share in California have either paused or restricted new policies in the state since last year.

Some state lawmakers tried to come up with a bill that would address the issue. But they failed to reach an agreement before the Legislature adjourned for the year last week.

Here’s a look at what California Insurance Commissioner Ricardo Lara proposed and how it would affect the state’s insurance market:

WHAT ARE THE RULES FOR INSURANCE COMPANIES?

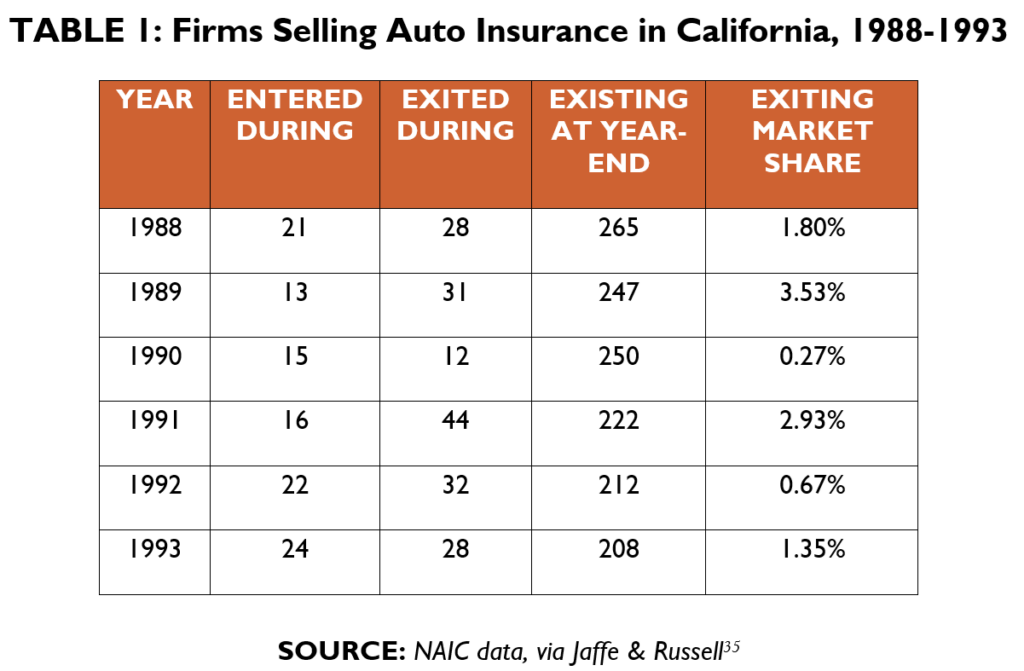

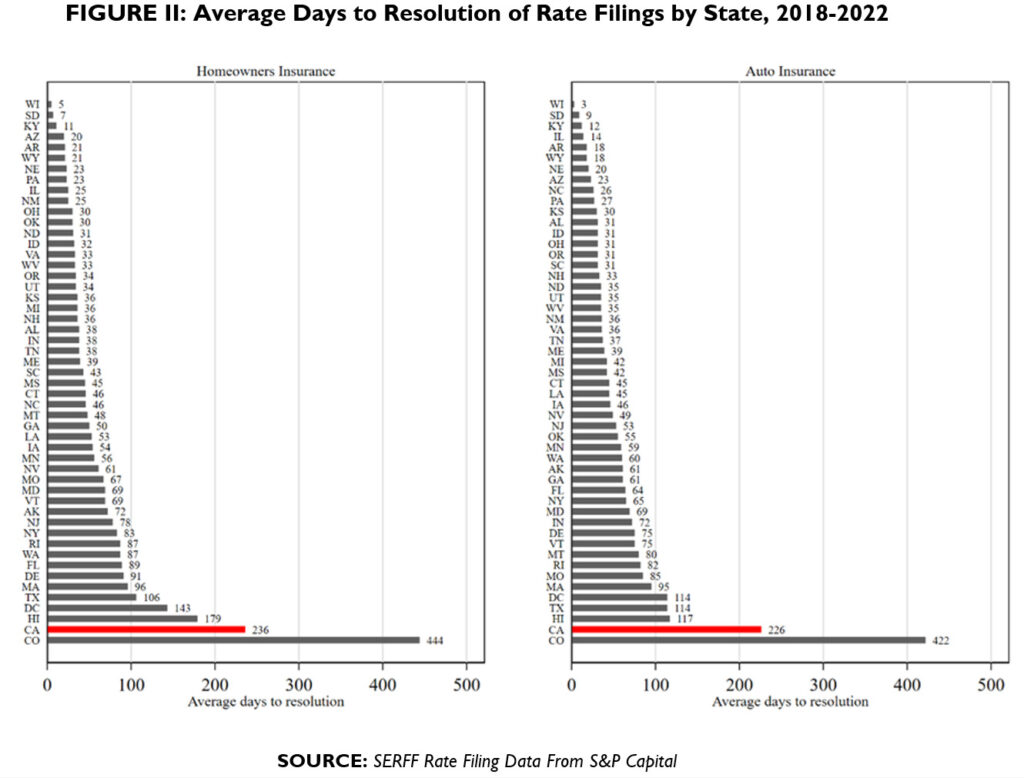

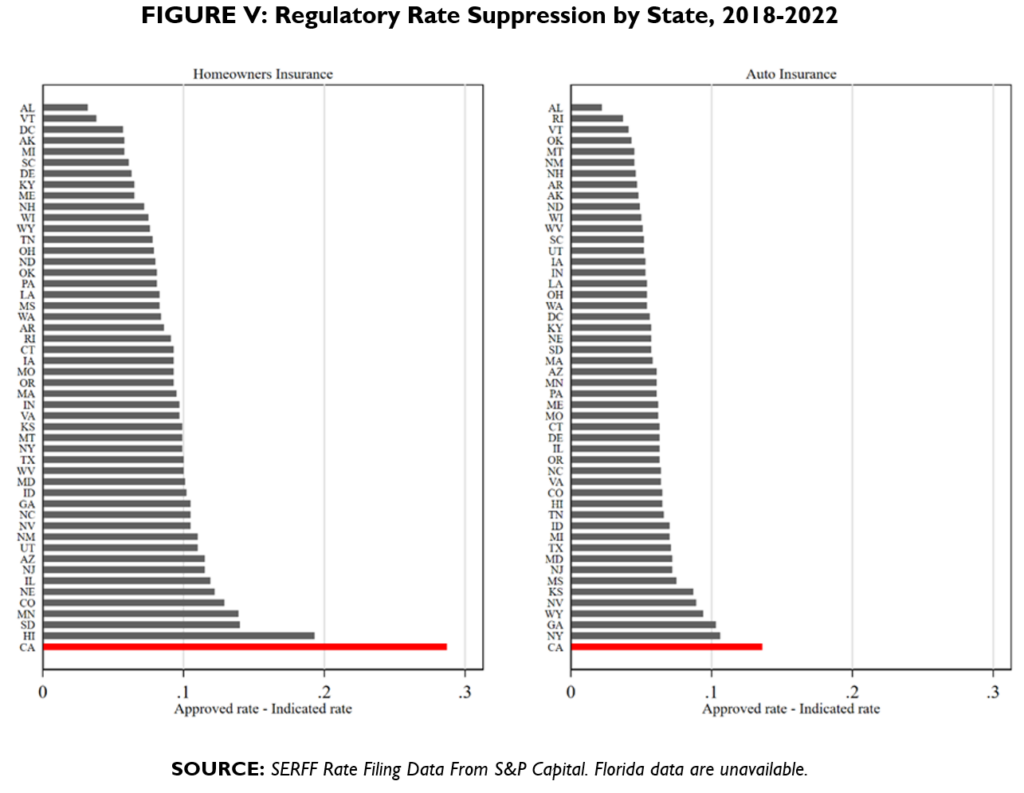

Unlike most states, California heavily regulates its property insurance market.

In 1988, California voters approved Proposition 103. It said insurance companies had to get permission from the state Department of Insurance before they could raise their rates.

When setting their rates, insurance companies cannot consider current or future risks to a property. They can only use historical data.

Insurance companies also buy insurance themselves, a process known as reinsurance. Companies are not allowed to consider their reinsurance costs when setting rates for California homeowners.

WHAT IS THE PROBLEM?

Climate change has intensified wildfires in California. Of the 20 most destructive fires in state history, 14 have occurred since 2015, according to the California Department of Forestry and Fire Protection.

Insurance companies say that because they can’t consider climate change in their rates, it makes it difficult to truly price the risk for properties. They also complain that they are having to pay more for reinsurance, which they cannot recoup from ratepayers.

Many insurers have responded by pausing or restricting new business in the state. They’ve also opted to not renew insurance coverage for some homeowners.

When homeowners who need insurance can’t get it from private insurance companies, they must purchase policies from the California Fair Access to Insurance Requirements (FAIR) Plan. The plan is primarily funded by policies sold to customers. Insurers only pay into the fund if it is insolvent or to keep it from going insolvent.

The number of people on the FAIR Plan has nearly doubled in recent years. Insurance companies are worried about this trend. If the fund were to go insolvent, insurance companies would have to cover the cost.

WHAT IS THE STATE’S PLAN?

California Insurance Commissioner Ricardo Lara said he will write new rules that would let insurers consider climate change when setting their rates. He has also pledged to consider rules that would let them consider some of their reinsurance costs.

The rules requiring insurance companies to get permission from the state to raise their rates would not change.

Lara said the state will only let companies use these new rules if they write more policies for people who live in areas threatened by wildfires. He said this means companies must write policies in these areas of no less than 85% of their statewide market share. That means if a company insures 20 out of 100 homes, the company would have to also write 17 policies for homeowners in an area threatened by wildfires.

HOW WILL THIS AFFECT RATES?

Some consumer groups, including the California-based Consumer Watchdog, fear that allowing insurance companies to consider climate change in their rates will lead to dramatically higher prices for homeowners.

But Lara said the new rules could also benefit homeowners. He said insurance companies could also consider improvements that owners have made to make their homes more resistant to wildfires. Companies could also consider the billions of dollars in public money that the government has spent to better manage forests and reduce wildfire risks.

If the rules work and more companies stay in California’s insurance market, it could increase competition for customers — potentially holding rate increases in check.

WHEN WOULD THE RULES TAKE EFFECT?

It would take a while for state regulators to write the rules. The process includes lots of time for insurance companies and consumer groups to give their input. Lara said he has given the department a deadline of December 2024 to have the new rules completed.

How to afford fire insurance in California

For the last five years (from August 2018 to August 2023), Californians have experienced an average of over 5,000 wildland fires per year, burning an average of over 800,000 acres per year.

Just how bad were these wildfires for property owners? In just the past two years – from 2022 to 2023 – wildfires in California caused at least $3.2 billion in damage. And California isn’t the only state with wildfire concerns. Most western states, including Arizona, have seen more wildfires – even Florida saw several wildfires in 2022. More recently, Hawaii was devastated by a series of deadly wildfires on the island of Maui.

The rising costs of damage from wildfires mean that insurance providers are paying more in claims, which means they’re turning to their own insurance providers – called reinsurers – with more claims on their policies. Essentially, everyone is feeling the pinch.

To manage their risk exposure, reinsurers typically have to raise prices for their customers. Their customers, the insurance companies, then have to raise prices for homeowners or send nonrenewal notices, effectively canceling homeowner's policies. In fact, nonrenewals in California have increased more than 31 percent since 2019.

This is a problem for those who live in areas with wildfire risk exposure. The good news is that if your current insurance provider sends you a nonrenewal notice or raises premiums beyond what you can afford, there are steps you can take to keep yourself covered for wildfire damage.

Is fire insurance mandatory in California?

Before we get to the steps for finding more affordable fire insurance, let’s first address another question: do you even need it? While there is no state-level law requiring homeowners to have fire insurance, most mortgage lenders do require it as a condition of the loan. So if you have a mortgage on your house, it’s safe to assume that fire insurance is mandatory.

Even if you own your home free and clear, carrying fire insurance is the safest option. Fires can spark from shorted-out appliances, lightning storms, downed powerlines, tossed cigarettes, and dozens of other activities you have no control over. Fire insurance helps make sure you and your family can live normally even if a disaster hits.

Fire insurance is included in most standard homeowners insurance policies.

Now let’s take a look at how California homeowners can find affordable fire insurance.

1. Shop around for fire insurance

It’s a good idea to shop around for fire insurance even if you don’t live in California – or if you live in a region of the state that’s not prone to wildfires. It’s a good idea to shop around for just about everything, and fire insurance is no exception.

-

Search online. Some newer insurance providers sell directly to customers and don’t work with outside brokers to keep costs low. (While we are a direct-to-consumer insurance provider, we don’t currently offer coverage in California.)

-

Ask friends for recommendations. If you have friends and family in California, ask them about companies they’ve worked with to insure their homes. Once you have a list of recommendations, start gathering quotes to compare.

Ideally, once you’ve explored additional coverage options, you’ll find one that works for your home and your budget. If you don’t, move on to the next step.

2. Consider non-admitted fire insurance carriers

Most of the insurance companies you’ve heard of are “admitted” carriers, which means they’ve been approved by a state’s insurance department. If the carrier went bankrupt, the state would cover payments for claims on active policies.

Non-admitted carriers are not approved by a state’s insurance department. They’re less regulated so they can take on more risk. Non-admitted insurance carriers may be the only workable solution for someone in a high-risk wildfire zone.

Non-admitted carriers are also sometimes called surplus carriers or specialty carriers. If you’re unable to find fire insurance through admitted carriers for your California home, see what some non-admitted carriers offer.

3. Call the California insurance helpline

If even after considering non-admitted carriers you can’t find a fire insurance policy to cover your home, it’s time to call California’s insurance helpline at 1-800-927-HELP.

This line is maintained by California’s Department of Insurance and is designed to help California residents figure out how to find adequate insurance. A helpline worker might point you toward the FAIR plan.

4. Consider California FAIR Plan fire insurance

The California Fair Access to Insurance Requirements (FAIR) plan is an insurer of last resort. Its website explicitly states that it is designed only for those homeowners who have made a “diligent effort” to find coverage elsewhere.

If you can’t find that coverage, though, the FAIR plan may be able to offer the fire insurance you need. If you do go this route, it’s important to understand a few things:

-

You’re responsible for knowing how much coverage you need. When you work with a private insurer, you can usually work with a representative who helps you understand the value of your home, your risk exposure, and the amount and type of coverage you need. With the FAIR plan, you have to calculate how much coverage to get on your own. You may want to work with an insurance broker to do this. Luckily, the California FAIR plan’s website explains how to find a broker.

-

California FAIR plan fire insurance doesn’t cover theft or liability. In this way, it’s different from standard homeowners insurance, which includes coverage for both theft and liability. If you purchase a policy through the FAIR plan, be sure to consider additional coverage to manage your other risks.

-

California FAIR plan coverage is limited to $1.5 million. If the cost of rebuilding your home is more than that, you’ll have to find supplemental coverage or attempt to self-insure by saving enough cash to make up the difference.

What to expect from California fire insurance prices

If you live in California and haven’t yet heard from your homeowners insurance provider, you may be one of the lucky ones – it’s possible your policy will be renewed with no major premium increases.

Individual cases may vary, though. One woman interviewed by the Wall Street Journal noted that, after getting a nonrenewal notice for a $2,350 policy, the only replacement policy she could find cost $18,000.

While that cost is extreme, it is likely less than the cost of rebuilding your home from scratch without insurance.

Comments

Post a Comment